Chapter 163, Part III, Florida Statutes (the “Florida Community Redevelopment Act”) provides a mechanism to enable a unit of local government to establish a Community Redevelopment Agency (CRA). The overall goal of the program is to encourage local initiatives in community and neighborhood revitalization and provide stabilization of the tax base.

The first step in creating a CRA is a “Finding of Necessity” that one or more geographic areas has conditions of “slum or blight”, and that there is a need to rehabilitate, conserve and redevelop that area. Accomplished by Resolution of the governing body, this finding means that the rehabilitation, conservation, or redevelopment or combination thereof is necessary. Collier County established a Community Redevelopment Agency with two separate Community Redevelopment Areas that include the Bayshore-Gateway Triangle CRA in East Naples, and the Immokalee CRA. The term of a CRA is typically thirty (30) years as this provides adequate time for the improvements to occur and provides a means to issue debt to initiate improvement projects within the blighted area(s).

The principal financing mechanism used in the redevelopment efforts is Tax Increment Financing (TIF) where an initial base taxable value of the taxing district is established. Incremental growth in the tax base (the tax increment) is then captured and reinvested directly within the CRA boundaries rather than accruing to the principal funds of the local government. In Collier County, these principal funds are the General Fund, which supports services provided on a county-wide level and the MSTD General Fund that supports services in the unincorporated area of the county. These tax increments support the CRA redevelopment initiatives by diverting funds that would otherwise be available to support Collier County general government operations.

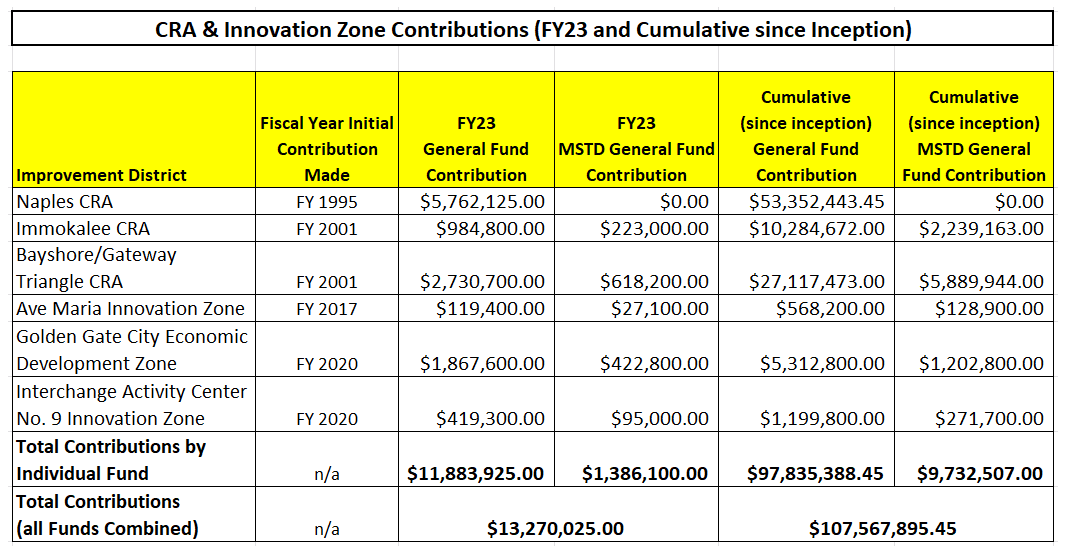

The following table summarizes the magnitude of the tax increments invested in the various CRAs within Collier County. The table includes tax increments of the various development/innovation zone. While these funds have a different purpose (spurring economic development), the tax increments diverted from general government operations have the same net impact as those of the CRAs. FY23 tax increments amount to $13.3 Million, while the cumulative tax increments amount to $107.6 Million.

Current Consideration in the Bayshore-Gateway Triangle

The Bayshore Gateway Triangle Community Redevelopment Agency (BGTCRA) purchased the site located at 4265 Bayshore Drive (17.26 acres) in 2006 and the 4315 Bayshore Drive site (0.63 acres) in 2008 for a total of $5,379,895.68. The 17.89-acres was rezoned in 2012 to Bayshore Drive Mixed Use Overlay District-Neighborhood Commercial (BMUD-NC) to accommodate the mixed-use development catalyst project identified in the BGTCRA Redevelopment Plan. It is important to recognize that when government purchases a property, it reverts to tax-exempt status and does not generate revenue.

The subject property was rezoned to a Planned Unit Development (PUD) called the Cultural Arts Village at Bayshore and provides for a maximum of 40 residential dwelling units and up to 48,575 square feet of commercial (retail, office and medical office), up to 84,000 square feet of parking garage space, a 350-fixed seat performance theater, and other ancillary uses. The maximum allowable height for property in the BMUD-NC district is four stories. The property has remained undeveloped and non-taxable since 2006.

One component of this intended catalyst project was an interconnect (walking pathway) from the 17-acre site to Sugden Park. In 2017, the CRA solicited proposals from developers to develop this property. Three proposals were submitted initially, but one proposal was subsequently withdrawn. The prior Board ultimately declined the two remaining proposals. On May 24, 2022, a contract with Stantec Consulting Services Inc., was executed to complete the design and permit a pedestrian connection from Bayshore Drive to Sugden Park on the 17.7 +/- acre property owned by the CRA. The terms of the Agreement provide for $278,024.00 in fixed costs including Conceptual Plan, Site Development Plan, Construction Plans and Permitting for the pedestrian connection (pathway and Boardwalk) to Sugden Park and $66,908.30 on Time and Materials – not to exceed basis for Bidding Services and Post Design Services.

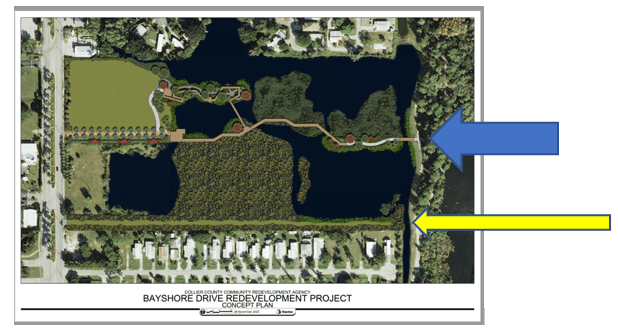

On December 13, 2022, the Board received a status report from CRA staff and Stantec representatives on the progress of the interconnect design. The interconnect is proposed through the center of the property including over water areas (see blue arrow below).

At the December meeting, the Board noted the following concerns: a lack of parking to provide citizen access to the interconnect from Bayshore Drive, building the interconnect without an approved plan for the full 17.7-acre site and absence of consideration of a southern option (see yellow arrow) within an existing right of way. Staff will be evaluating cost alternatives for optional location designs for the interconnect and will bring those back to the Board for future discussion and a determination of how to proceed. There was no discussion of the prior options submitted by developers, or possible re-solicitation for viable projects that might provide for connectivity and would also put the area back on the tax rolls as private vs government ownership, at a probable increased value.