Annually, the Board of County Commissioners (BCC) approves the subsequent years’ budget in the second of two public hearings in September. The development of the County’s budget is a roughly 8-month process, beginning with the Board’s annual adoption of a budget policy in February or March. Typically, these meetings are brief and not well attended by the public. Not so for the hearings held this September for purposes of adopting the FY-24 budget for Collier County.

The first public hearing was held on September 7, 2023, and was an indication that the budget process would be more labor intensive than in prior years. At the first budget hearing staff historically presents the Board of County Commissioners with a tentative budget based upon the adopted budget policy and notes any exceptions to the policy during their presentation. Key elements of the policy are the millage assumptions and the suggested increases, or decreases, in operating budgets for ad valorem funded divisions. Based upon this approach, staff proposed a $2.1 billion dollar County budget to the Board.

The County’s budget is a complex document covering the myriad of services that the County provides its citizens. Such services include public safety, transportation, parks and recreation, beach renourishment, water and sewer and solid waste, just to name a few. Despite the vast array of services provided by the County, many with their own fee used to offset the cost of the service, the primary focus of discussion in most budget years is the ad valorem tax paid by homeowners and commercial interests. Ad valorem means in proportion to the estimated value of the good or service, in this case the estimated value of real property and improved real property. The value of the property is estimated, or assessed, by the Collier County Property Appraiser, an independently elected constitutional officer.

A millage is applied against the assessed value of the property to derive an amount of ad valorem tax due in any given year. The BCC sets this millage rate as part of their annual budget process. The County’s General Fund millage rate, paid by all landowners living within Collier County, has been the same, 3.5645, for fourteen (14) consecutive years. Holding the millage rate static for this length of time, even during recent inflationary economy, was made possible largely due to the net increase in assessed value over the same period. The tentative budget brought to the Board for consideration on September 7, 2023, was based upon the adoption of the same General Fund millage rate adopted for the FY-23 budget.

Each year a decision must be made by the Board to raise, lower or maintain the millage rates. A key concept in this process is the roll back rate. The roll back rate is that millage rate which, when multiplied by the new assessed value, generates the same dollar amount of ad valorem revenue as the previous year. This was a topic of conversation at the first budget hearing and the result was direction by the Board to staff to identify programs that could be decreased, or cut, to make up for the decrease in ad valorem revenues brought about by the potential adoption of a reduced, or even a rolled back millage rate.

The discussion about where to cut ad valorem taxes focused on Conservation Collier and budget requests that were over the adopted budget policy. The Conservation Collier program is a land purchase and maintenance initiative designed to protect, and provide access, to greenspace in Collier County. According to Resolution No. 2020-22, the program can levy a maximum millage rate of .25 mils a year. Like the General Fund millage, this tax is levied County-wide, and all landowners pay into this program. The budget requests that were over policy included an infusion to County-wide capital reserves of $17.5 million and expanded County Manager and constitutional officer requests totaling $8.3 million.

At the conclusion of the first budget hearing the Board gave direction to staff to bring back suggestions to the Board that would allow for a reduction in millage between the neutral rate and the rolled back rate. The metric used was the desire to cut the budget back to the 4.75% operating budget increase in the adopted budget policy, the magnitude of the proposed decrease was $27 million.

At the second budget hearing, which lasted into the early morning hours (around 2:30 am) the Board heard public input primarily centered on the proposed reduction in Conservation Collier millage. There were a few public speakers desiring relief from ad valorem taxes, but many speakers were those ardently supporting the Conservation Collier program and its goals. In the end, the Board moved forward with even deeper cuts to ad valorem than previously suggested, moving to the actual rolled back rate in all County-wide millages.

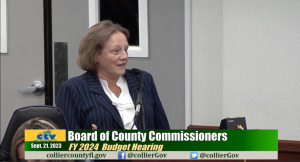

Aggregate county-wide ad valorem tax revenues were decreased by a total of $53.9 million dollars, with $3.6 million dollars cut from the Conservation Collier program tax levy. The Board also reduced the Unincorporated Area General Fund tax levy to the rolled back rate, resulting in a $6.9 million dollar reduction to that tax levy. The cumulative reduction to the FY 2024 tax levy was $60.9 million dollars.

In subsequent action at the October 10, 2023 County Commission meeting, the Board decided that the Conservation Collier funds would be used on an as needed basis to support General Fund operations, with the caveat that funds would subsequently be reimbursed to Conservation Collier.

It is always our goal to provide the best services possible at the lowest costs possible, we will continue to look for efficiencies and review processes to ensure our services to the community are not diminished. The Clerk’s continued funding was supported by the Board, and we are thankful for their support of our continued services.