Ten months after the initially proposed project developer of the new Golden Gate Golf Course terminated its lease due to an inability to secure funding, a new long-term lease and operating agreement with The Gate Golf Club, Inc. (The Gate) was approved by the Board of County Commissioners (BCC) at their April 23, 2024, meeting with all commissioners in favor.

On December 12, 2023, the Board directed staff to develop and solicit an Invitation to negotiate for the design, construction, and operation of the Golden Gate Golf Course and received two proposals before the deadline. After the presentations and discussion with the Selection Committee, The Gate Golf Club, Inc. was selected to begin negotiations for a new lease and operating agreement to develop the Golf Complex.

Some key points from the contract include:

Some key points from the contract include:

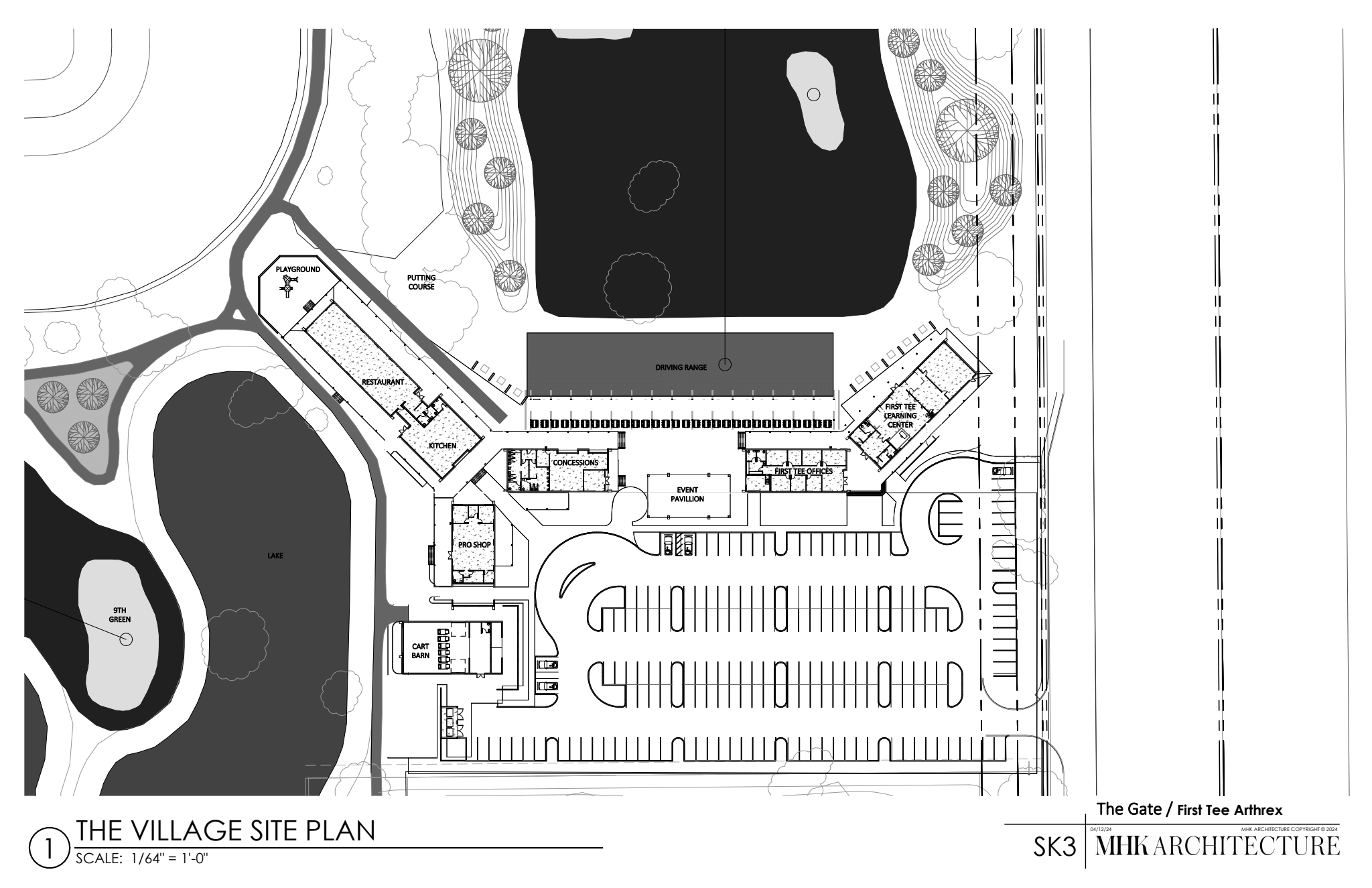

- The Gate will design, permit, and construct the nine-hole golf course, driving range/practice area, and related golf course amenities comprising the “Golf Complex.”

- The lease has an initial term of 40 years with the option for four (4) five-year renewals.

- The Gate will pay an annual base rent of

- If it is determined by the Gate that any required environmental remediation will exceed $250,000 (“Remediation Cap”), The Gate may elect to terminate this agreement, or the County has the option to either pay the difference between the remediation estimate and the Remediation Cap or terminate the Lease at no cost or penalty.

- Construction shall be completed within twenty-four (24) months from issuance of final site-related permitting.

- The Gate is permitted to retain a third-party operator. The Gate has selected Affiniti Golf Partners, LLC, d/b/a Bobby Jones Links, a private club management company, to manage its operations. According to the Lease, the County is responsible for approving third-party operators. Therefore, as part of the Lease approval process, the Board approved Bobby Jones’ management of the course.

- The Gate will provide a resident discount of 40% on seasonal rates and 20% on off-season rates. The Gate and Bobby Jones estimate the annual value of discounts to be $600,000.

- The Gate will sublease land to First Tee for the purposes of building a clubhouse with classrooms, offices, conference rooms, and storage. First Tee staff and volunteer coaches play for free during First Tee supervised programming periods.

At the April 23rd BCC meeting, the agreement established that the estimated total cost of the construction is $21 million, of which $6 million will be provided by the County to support the project, and any investment above that amount will be the responsibility of The Gate. In total, aside from the one-time payment of $6 million, the County would have contributed an additional $23 million in land ($211,000 per acre land acquisition cost x 109 acres) for the lease of the property.

It has been several years since the land was purchased, and a golf project was proposed. The changes in developers and contract agreements show its complexity. I will continue to point out several areas of concern and improvements that might be considered regarding this development.

It has been several years since the land was purchased, and a golf project was proposed. The changes in developers and contract agreements show its complexity. I will continue to point out several areas of concern and improvements that might be considered regarding this development.

When the County purchased the larger parcel with borrowed funds of $30M, there was no indemnification for environmental hazards on the land. One of the key terms of this agreement is that The Gate has the right to terminate the agreement if the required environmental remediation exceeds $250,000, or the County can pay any differential above the $250,000 remediation cap. As of this writing, there has been no estimate for the total cost of remediation. The risk of additional expenses remains a concern.

The current phased rent structure and total annual base rent of $130,000 per year that the developer will pay the County seem disproportionate to the investment and funding contributed. Factoring in the discounts provided to Collier County residents of 40% in-season rates (with an estimated price of $53.40 for a round of front-9) and 20% off-season rates (with an estimated price of $31.40 for a round of front-9), an estimated total value of discounts at $600,000. $20M in debt on the Golf parcel remains.

As the project is still essentially in its first phase, with plans, development, and funding negotiations still underway, I hope these concerns will be addressed moving forward.