Local governments routinely borrow funds to pay for multi-million-dollar capital projects that have a long-term useful life. Examples of typical long-term projects include major road expansions, water and wastewater plant construction, landfill expansion, and government facilities. By issuing debt for a project with a useful life of 20-30 years, future residents pay a pro-rata share of resources that they use through impact fees, user rates and/or taxes.

The creditworthiness of the local government is evaluated by external bond rating agencies, which assign a rating to a proposed bond issue that ultimately impacts the cost of borrowing. For a government, it may mean the ability to borrow funds at more competitive rates to hold down interest costs on those long-lived assets that are debt-funded. The difference in borrowing costs for a “AAA” rated issue versus an “A” rated issue can be millions of dollars over the life of the bond.

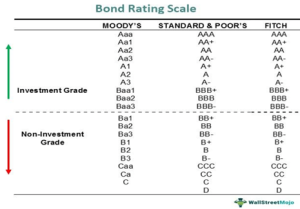

Ratings are assigned to a proposed bond issue by external bond rating agencies. Fitch Ratings Service, Standard and Poor’s and Moody’s Investor Services are the three most recognized rating agencies in the industry. The rating agencies have professional analysts to analyze the potential risk for an investor to invest in a particular bond. These agencies apply different parameters to assess the quality of the bond through a bond rating chart. In Florida, the only Counties with AAA rated governmental ratings (non-utility) are Broward, Hillsborough, Palm Beach, Sarasota, and Collier. As there are sixty-seven (67) counties in the State of Florida, this is a select group.

Rating agencies make regular surveillance calls to update the County’s financial position and to determine whether the current bond rating is still warranted. The major factors in the determination of the rating include: (1) the coverage generated by the revenues that are pledged to the repayment of the debt, (2) the underlying demographics of the governmental entity and its citizenry, and (3) the strength of management. Major changes to the County’s economic outlook or the revenue stream previously pledged could result in a downgrade to the bond rating.

As noted below, there is not a uniform rating scale used by all three rating agencies. For comparison purposes, a Aaa rating by Moody’s is equivalent to a AAA rating by Standard & Poor’s and Fitch.

Fitch Ratings recently affirmed Collier County’s issuer credit rating of AAA in April 2023. Likewise, Moody’s Investor Services and Standard and Poor’s have assigned issuer credit ratings of Aaa and AAA, respectively, to Collier County. These are the highest ratings assigned by the major credit agencies and indicate that the bond issuer’s capacity to meet its financial commitments is extremely strong.

In addition, the Collier County Water and Sewer District (District) is rated AAA and Aaa by Fitch and Moody’s Investor Services, respectively. Standard and Poor’s does not currently maintain a rating on Water and Sewer District debt. Water and Sewer District debt is evaluated separately from general government debt, as enterprise debt is self-supporting through user charges to customers of the utility system.

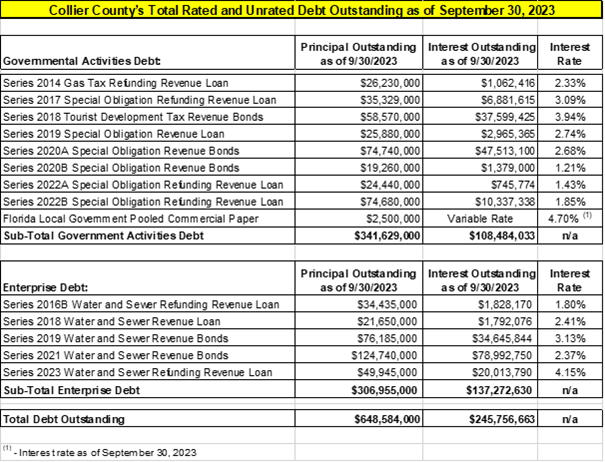

The following table summarizes Collier County’s debt outstanding as of September 30, 2023.

Through the County’s finance committee and financial advisor, the debt portfolio is evaluated regularly for opportunities to generate savings through debt restructuring. Countywide capital allocations have traditionally included new money components for general governmental capital projects, as well as maintaining and replacing existing general governmental infrastructure.

After embarking upon an aggressive debt restructuring program in the summer of 2010, over $531.2 million in general governmental debt has been refinanced. As a result, the cost of borrowing has been reduced by $3,071,488 annually, with this recurring savings applied toward high-priority pay-as-you-go operating and capital programs.