Individual Florida counties may impose an infrastructure sales tax. Collier County proposed the discretionary surtax to pay for local authorized infrastructure projects. Voters must approve the one-cent sales surtax via referendum; the referendum question was on the November 2018 General Election ballot and was approved by the voters. Collections commenced on January 1, 2019.

Collier County Ordinance No. 2018-21 includes an automatic sunset date of December 31, 2025 (7-year term). However, the ordinance also has a provision for an earlier sunset date of December 31st of any year in which the total aggregate distributions of surtax proceeds for all governmental units (Collier County, City of Naples, City of Marco Island, and Everglades City) equal or exceed $490,000,000 at any time during that calendar year.

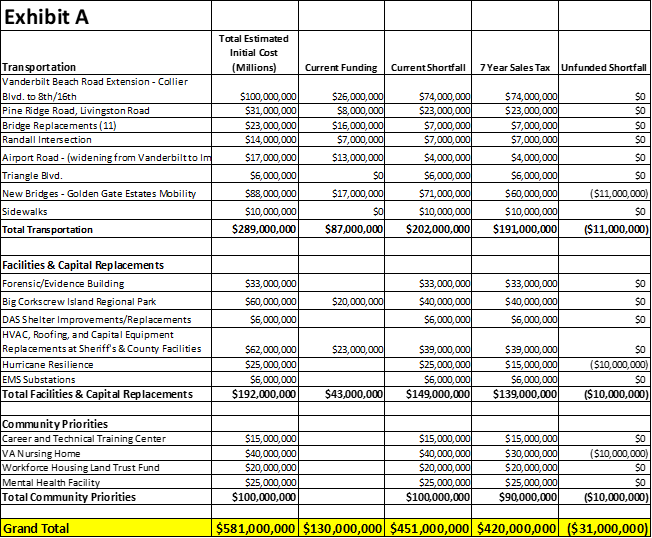

The table below identifies the projects to be funded, in whole or in part, with surtax proceeds. The $420M represents the County’s share of the anticipated $490M in overall funding.

Sunset of the Existing Infrastructure Sales Tax in Collier County

On October 10, 2023, the Collier County Board of County Commissioners adopted Ordinance 2023-45, sunsetting the 1% Infrastructure Sales tax effective December 31, 2023. The tax generated the targeted amount of $490 million over two years earlier than the original estimated time frame. Such performance is further notable as a global pandemic occurred during this same time-period.

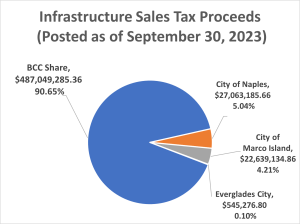

Collections posted through September 30, 2023, amount to $539,296,882.68. The following pie chart reflects the actual distributions to each of the respective local governments sharing in the proceeds (based on population). There will be three months of additional postings as state law dictates that the tax must cease on December 31 of a given year.

Potential Reauthorization of the Infrastructure Sales Tax

Discussions have already begun regarding the potential reauthorization of the tax. The tax was split among the following governmental units (Collier County, City of Naples, City of Marco Island, and Everglades City). The repeal of the tax impacts the cities in Collier County as they received over $50.2 million to date since the inception of the original levy.

In particular, the City of Marco Island has indicated support for the reauthorization of the 1% tax levy. Marco Island formally indicated their support of voter approved reimposition to Collier County by letter, citing Marco Island’s 7 consecutive years of rolled-back millage rates and the resultant tax relief. In addition, Marco Island reinforced the idea that the burden of the surtax is borne not just by residents, but also visitors that place demands on each government’s infrastructure. Since inception of the tax, the City of Marco Island has collected $21 million and has used the proceeds for road improvements, parks, and a fire station.

Many of the factors that prompted the imposition of the initial surtax are still present. Collier County continues to grow at a high rate with much of the County surtax funded projects coming in substantially over their budgeted estimates. Without reimposition of the surtax, funding for additional mission critical infrastructure would have to be found elsewhere through cuts to other projects or possible borrowing. Interest rates are much higher now than when the tax was originally adopted. The Board of County Commissioners approved a rolled back millage rate for fiscal year 2024 property taxes which provided some tax relief, but limited funding for additional projects.

Any future plans to reimpose the infrastructure sales tax would only occur after consulting community partners and the municipalities. At the Board of County Commissioners’ direction, staff is preparing an agenda item for discussion at the December 12, 2023, County Commission meeting. As always, you are able to attend the Board of County Commissioners’ meeting in person or watch it online (download agenda here). Discussions will include the anticipated timeline and necessary steps to place a reauthorization referendum on the ballot in 2024. This discussion may be heard in conjunction with a review of the County’s infrastructure planning document entitled the Annual Update and Inventory Report (AUIR) that identified major funding shortfalls in Transportation and Stormwater Management projects. The Board members noted that ultimately this decision would be made by the voting public. Stay tuned for more information!