Private roads are required to be passable for emergency vehicles to ensure ease of transport during disasters. While repairs for many roadways are the responsibility of the government, not all repairs are the government’s responsibility. For example, most private roadways are required to be maintained by either Homeowner Groups or private individuals. Government funding is not typically allocated for private projects. In December 2023, the Board of County Commissioners established the Private Road Emergency Repair Municipal Service Taxing Unit (MSTU) to address funding concerns. The MSTU aims to serve as a funding mechanism for emergency repairs of unpaved privately owned roads deemed impassable by the Sheriff’s Office, local fire districts, or County emergency vehicles. A special taxing district was developed consisting of citizens who are within the parameters of the identified private roads.

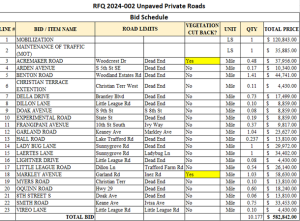

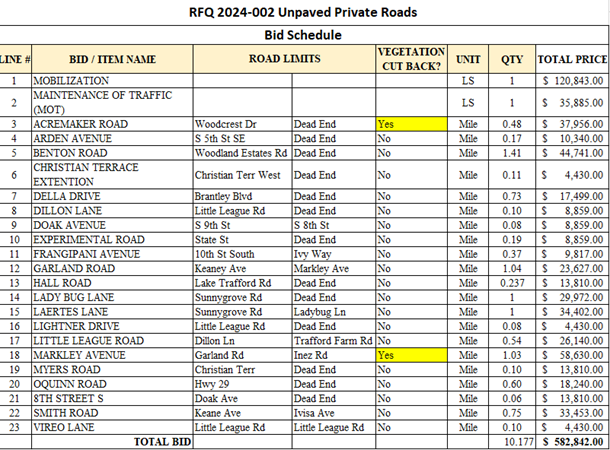

The County received two quotes for Roadway Contractor Services, recommending that the lowest responsible bidder, Quality Enterprises USA, Inc., be awarded the work in the total bid amount of $582,842. The unpaved private roads have been identified, along with estimated costs for each road repair:

The tentative FY25 budget proposes a tax levy of 1Mil within the MSTU. The proceeds from the tax levy are anticipated to generate approximately $38,000 annually.

At $38,000 per year, it will take more than 15 years to pay the estimated costs of repairs, without considering administrative costs such as Property Appraiser and Tax Collector fees, indirect service charges, etc. Funding would not be available to maintain or further improve these or additional private roads during the 15+ year loan repayment period without added borrowing from other funds or an increase in the millage assessed.

Based upon this information, Commissioner McDaniel suggested this be studied further as the costs far outweigh the generated millage revenues. This will require ongoing discussions to find a sustainable solution.