The County’s budget is a complex document covering the myriad of services that the County provides for its citizens. Such services include public safety, transportation, parks and recreation, beach renourishment, water and sewer and solid waste, just to name a few. Despite the vast array of services provided by the County, many with their own fees used to offset the cost of the service, the primary focus of discussion in most budget years is the ad valorem tax paid by homeowners and commercial interests. Ad valorem means in proportion to the estimated value of the good or service, in this case the estimated value of real property and improved real property. The value of the property is estimated, or assessed, by the Collier County Property Appraiser, an independently elected Constitutional Officer.

Collier County staff initiates the budget process by developing a recommended budget policy that includes a multi-year analysis of the General Fund and the Unincorporated Area General Fund, as these funds are the principal County tax-supported operating funds. The analysis reflects the estimated impact of the proposed budget policies on the respective budgets and associated millage (tax) rates.

Collier County staff initiates the budget process by developing a recommended budget policy that includes a multi-year analysis of the General Fund and the Unincorporated Area General Fund, as these funds are the principal County tax-supported operating funds. The analysis reflects the estimated impact of the proposed budget policies on the respective budgets and associated millage (tax) rates.

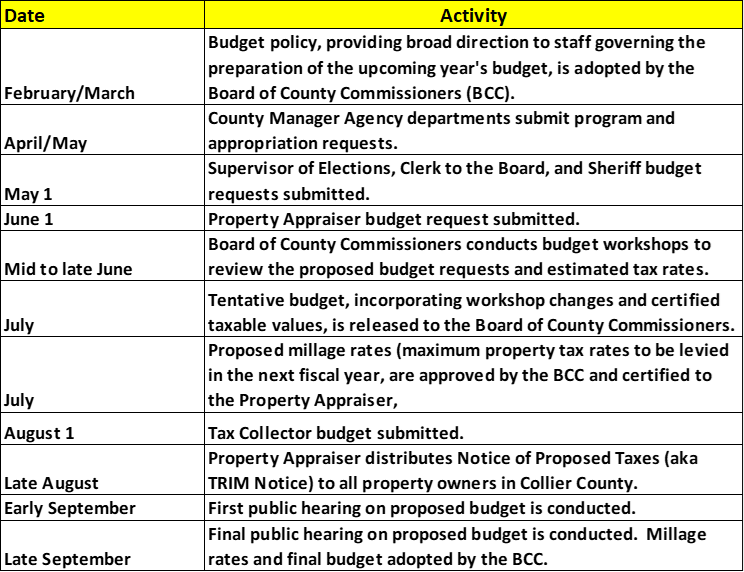

The recommended budget policy is presented to the Board of County Commissioners in late February or early March. The Board approves the broad policy guidelines (millage rate recommendations, capital funding allocations, level of service standards, salary adjustments, limitations on operating budgets, and position guidance) that govern the development of the budget, which are incorporated into a budget instruction manual for staff.

Year to date financial information through February (five months of the County fiscal year) is included in the budget module to assist with revenue and expense year-end forecasting. County staff and the Constitutional Officers develop their respective budget requests for the upcoming fiscal year October 1 – September 30th. Requests are broken into two categories: Current Services and Expanded Services. Current Services include the cost of providing existing services. Expanded Service requests include enhancements to existing programs, new programs and/or position requests. The Expanded Service column focuses attention on any service requirements that may be necessitated by a growing population or level of service increases.

OMB staff reviews and makes recommended changes to the proposed budget requests in conjunction with the operating departments. The Constitutional Officers: Supervisor of Elections, Clerk to the Board, and Sheriff submit their respective budget requests by May 1; the Property Appraiser submits their budget by June 1; and the Tax Collector submits his budget request on August 1, in accordance with Florida Statutes. As a side note, to ensure separation of powers, the Property Appraiser and Tax Collector budgets are approved by the Florida Department of Revenue, rather than the Board of County Commissioners.

County internal budget reviews are conducted with the County Manager in May. At that time the County Manager’s recommended budget for the upcoming fiscal year is finalized. On June 1, the Property Appraiser provides a preliminary estimate of taxable value for the upcoming fiscal year. This provides taxing authorities with important information for budget planning purposes. Tax supported budgets are re-balanced to reflect this information. In June, the Board conducts workshops to review the tentative budget and makes preliminary policy decisions regarding the proposed budget. On July 1 the Property Appraiser certifies a tax roll for the upcoming fiscal year. The budget is changed to reflect the updated property valuations. A tentative budget summary is provided to the Board of County Commissioners in accordance with State Truth in Millage (TRIM) requirements.

In late July all taxing authorities adopt proposed tax rates. These tax rates represent the maximum rates for state statutory Truth in Millage (TRIM) purposes and may be maintained or reduced during public hearings in September. (Note: There are emergency provisions by which the proposed tax rates may be increased, subject to very onerous public notice requirements). The Property Appraiser then assimilates all the proposed tax rates and generates the Notice of Proposed Taxes (TRIM Notice). This notice provides the taxpayer with the maximum tax impact of the proposed millage rates to be levied by the various governmental units (County, City, School District, etc.) and the updated valuation of each property as established by the Property Appraiser.

Florida Statutes require two advertised public hearings on the budget. The Notice of Proposed Taxes serves as the public notice for the first public hearing held in September. Thereafter, the final hearing is noticed and conducted in accordance with State TRIM provisions. The public is allowed to speak on any topic prior to the final adoption of tax rates and the budget. Upon adoption of the budget by the Board of County Commissioners, appropriations are uploaded into the County financial system. The ensuing fiscal year begins on October 1. The annual budget development cycle is depicted in the following budget calendar.

Budget Calendar

Budget formulation, adoption, and execution in Collier County involve the year-round interaction of many people at various levels within the County. The purpose of the process is to identify service needs, develop strategies to meet those needs and develop detailed revenue and expenditure estimates to carry out the financial plan. As such, the budget process incorporates the following activities:

Public Hearings – Fiscal Year 2025 Budget

The first public hearing was held on September 5, 2024. At the first budget hearing, staff presented the Board of County Commissioners (Board) with a tentative budget based upon the adopted budget policy and noted exceptions to the policy during their presentation. Some of the key elements of the policy are the millage assumptions and the suggested increases, or decreases, in operating budgets for ad valorem funded divisions. Based upon this approach, staff proposed a $2.15 billion dollar County budget to the Board. The proposed countywide millage structure presented to the Board on September 5, 2024, was based upon a millage neutral approach. A millage neutral approach keeps the millage the same as the previous fiscal year and will generate more revenue due to growth in existing property values over time, as well as new construction added to the tax roll. The following millages are levied on a countywide basis:

- County General Fund

- Water Pollution Control

- Conservation Collier

The Board’s recommendation during the first budget hearing was the adoption of a rolled back millage rate. The rolled back millage rate generates the same property tax revenues as the prior fiscal year, exclusive of new construction added to the tax roll. The change to a rolled back millage rate resulted in a final total net budget presented to the Board at its final budget hearing on September 19, 2024, of $2.11 billion.

A millage is applied against the assessed value of the property to derive an amount of ad valorem tax due in any given year. The Collier County Board of County Commissioners’ sets this millage rate as part of their annual budget process. Prior to FY-24, the County’s General Fund millage rate, paid by all landowners living within Collier County, had been the same, 3.5645, for fourteen (14) consecutive years. For FY-24 the Board adopted a rolled back General Fund millage rate at 3.2043. Subsequently, for FY-25, the General Fund rolled back rate was again adopted by the Board at 3.0107.

For the second year in a row, the Board also adopted rolled back millage rates for the Conservation Collier program and Water Pollution Control, both of which are countywide millages. The Conservation Collier program is a land purchase and maintenance initiative designed to protect, and provide access, to greenspace in Collier County. The program can levy a maximum millage rate of .25 mils a year. The Water Pollution Control millage funds the planning, development, and implementation of programs that protect the safety, health and welfare of the community and its environment with a focus on the protection of Collier County’s drinking water supply from all sources of pollution. At the second budget hearing, with the adoption of the rolled back rates for all countywide millages for FY-25, aggregate countywide ad valorem revenues were decreased by a total of $32.0 million dollars, when compared the amount that would have been generated by a millage neutral budget.

Note: Budget development discussion and budget calendar excerpted from Collier County budget book.