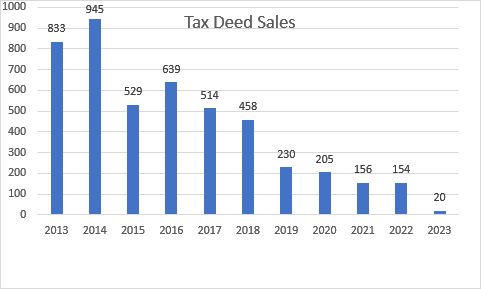

Did you know that, per FL statute 197.502, one of the many duties the Clerk’s office performs is the sale of properties that are delinquent on their real-estate taxes? We refer to this sale as Tax Deed sales.

The story begins when the Tax Collector’s office sells a Tax Certificate to pay off the delinquent real-estate taxes. If those taxes due remain unpaid for 2 years, the Tax Certificate holder can force a sale of the property. This is where the Clerk is called upon to hold the Tax Deed sale. The Tax Deed group in the Recording Department conducts Tax Deed sales via in-person public auctions. Auctions are duly noticed on Notices.CollierClerk.com. Auctions are periodically held on Mondays in the Courthouse Annex, 1st floor multi-purpose room at the Collier County Government Complex located at 3315 Tamiami Trail East, Naples FL 34112.

The Clerk’s sole responsibility is the sale of the property based on information that the Tax Collector provides to the Clerk. The bidder is responsible for researching the property prior to the sale for possible liens. The Clerk does not guarantee clear and marketable title to the property. “Caveat Emptor/Buyer Beware.” Property is sold “as-is”. Florida Statute prohibits the Clerk’s Office from providing legal advice and/or opinions concerning the real estate properties sold at auction. At the time of the sale, the successful bidder must provide a non-refundable deposit of 5% of the bid price or $200, whichever is greater. The remaining balance is due within 24 hours.

More details are available at CollierClerk.com/Tax-Deed-Sales.