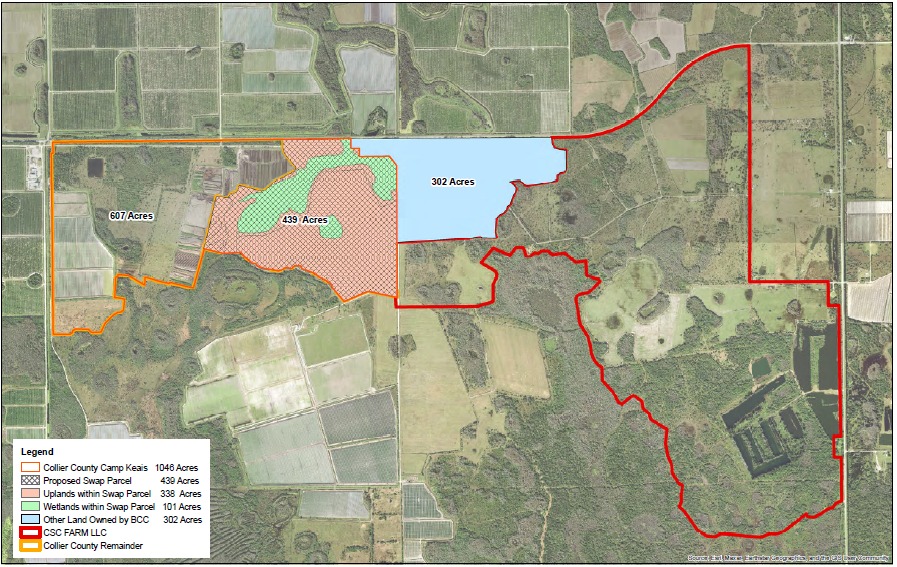

The Barron Collier Companies has submitted an unsolicited proposal to exchange approximately 439 acres at Camp Keais for 439 acres within its Silver Strand property. This proposal was brought to the Board at their August 27th meeting to provide staff with direction on a response to the proposal. The BCC vote 4-1 to further review the proposal. The proposed swap requires appraisals and other pre-contract research, such as environmental conditions and suitability for activities currently planned for the Camp Keais property.

The Barron Collier Companies has submitted an unsolicited proposal to exchange approximately 439 acres at Camp Keais for 439 acres within its Silver Strand property. This proposal was brought to the Board at their August 27th meeting to provide staff with direction on a response to the proposal. The BCC vote 4-1 to further review the proposal. The proposed swap requires appraisals and other pre-contract research, such as environmental conditions and suitability for activities currently planned for the Camp Keais property.

It is important to note that the Camp Keais property acquisition was funded with outstanding debt estimated at $14.97M, including interest payments. Pro-rata debt service (439 acre/1046.19 acres) would amount to $6.3M. The property was initially purchased from Barron Collier Partnership, LLLP for the purpose of relocating the fairgrounds as well as providing opportunities for utilization by Parks & Recreation, Public Safety, hurricane debris management, horticultural processing, and workforce housing. The current principal and interest balance attributable to the portion requested in Camp Keais is approximately $9.6M. Consideration for pricing of the parcel should include the assemblage of 1046.19 acres, which has considerably more value than a piece that might be segregated from the total parcel owned by the county.

Staff has recommended appraising both the Camp Keais property and the property owned by Barron Collier Companies and conducting other appropriate due diligence. Barron Collier Companies has expressed their willingness to shoulder the costs associated with the appraisals and due diligence.

The Collier County Fair Board and Swamp Buggy organization possible relocation to the newly proposed “swap” site should be evaluated before appraisals are prepared or other costs are incurred. Other outstanding considerations include: Is the appraisal based upon the best and highest use of the property or other considerations? Are any of the parcels part of Sending or Receiving lands? What remediation would be required of all parcels, and who is responsible for the cost of those reviews and remediation costs?

We have routinely expressed the importance of total planning prior to any land transactions. In this case, where there is debt to be covered, proposed uses that were defined at purchase, and if considered, a great deal of additional staff time is required to vet the issues and re-plan uses of the remaining 600+ acres as well as the property received in exchange. There should be a FULL plan (including all uses, estimated required acres, cost/benefits, debt repayment, and time frames) in place PRIOR to any buy/sell/exchange.