On April 9, 2024, the Clerk and Comptroller’s Office delivered the FY2023 Annual Comprehensive Financial Report (ACFR) to the Board of County Commissioners at its regularly scheduled meeting. This report is required by Florida Statute to be audited by an independent certified public accountant and filed with the State of Florida by June 30, 2024. To receive a favorable, or “unmodified” audit opinion, the County must submit a financial report that was prepared in accordance with generally accepted accounting principles as they relate to local governments.

Accounting rules for governments, including counties, are promulgated by the Governmental Accounting Standards Board of the Financial Accounting Foundation. These rules require that financial information be reported in two major activity categories, governmental and business-type on an entity wide basis, as well as on a fund-by-fund basis. The governmental and business-type activities are reported on a full accrual basis and the individual fund information is reported on a modified accrual basis for certain funds and a full accrual basis for others.

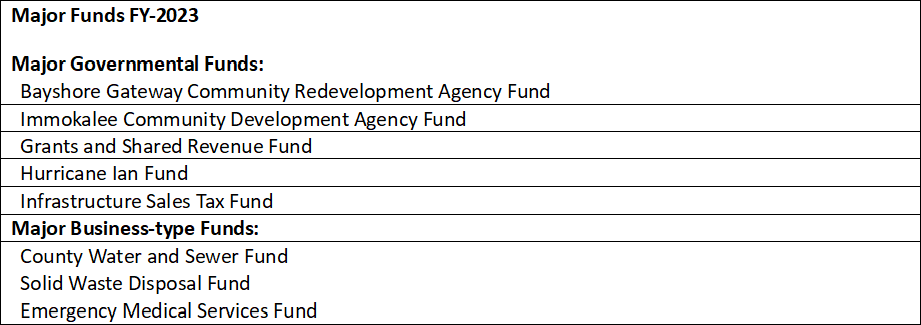

Also required in the Annual Comprehensive Financial Report is a section entitled Management’s Discussion and Analysis (MD&A). The MD&A usually includes financial highlights, overviews of the financial statements and details on the entity’s revenue and expenses both at the entity wide level and on a fund-by-fund basis for major funds. Major funds are determined by size, based upon assets, liabilities, revenues or expenses, or particular importance to the entity. The following is a list of Collier County’s major funds for the fiscal year ended September 30, 2023:

The MD&A also offers information on the County’s capital assets, outstanding debt and General Fund budgetary highlights. Overall, Management’s Discussion and Analysis is an unaudited narrative overview of the financial activities of the County for a given fiscal year.

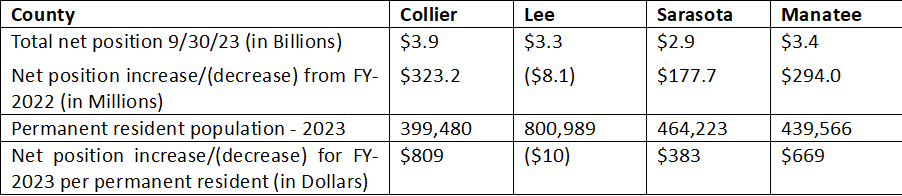

The County’s total assets and other debits exceeded its total liabilities and other credits by $3.9B as of September 30, 2023. This measurement is known as net position, and it serves as a useful indicator of a government’s financial situation. Collier County’s net position increased by $323.2M, or $809 per permanent resident, when compared to fiscal year 2022. This increase was largely due to Infrastructure Surtax, Conservation Collier and governmental impact fee collections. Also contributing to this increase was a $52.3M increase in County water and sewer net position, largely attributable to a 7% mid-year increase in user fees. Below is a table showing Collier County’s net position relative to peer counties.

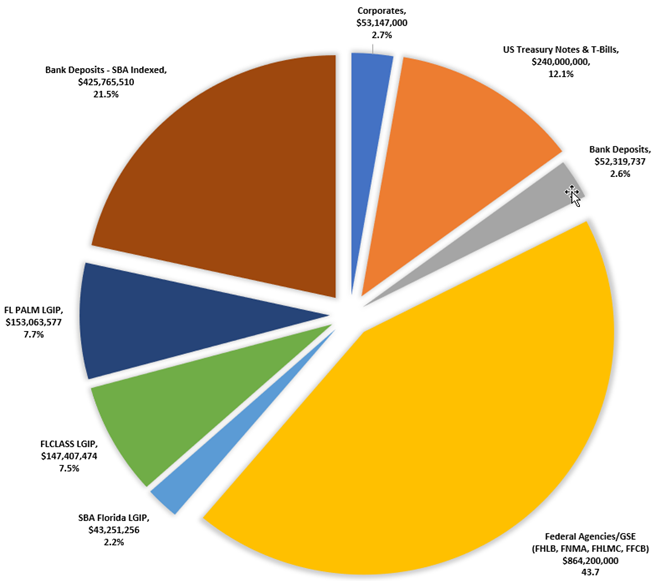

The County’s aggregate pooled cash and investments were $2.0B as of September 30, 2023. Of this amount, $31.1M was held in fiduciary funds pending disbursement to other governments and individuals. The total interest earnings for fiscal year 2023, including unrealized gains resulting from marking long term investments to their market value, was $83.7M. By statute, the Clerk and Comptroller’s Office is the investor of funds for the Board of County Commissioners. Below is a chart showing the allocation of the Board of County Commissioners’ cash and investment holdings as of September 30, 2023.

The majority of Collier County’s net position, or 64%, consists of capital assets such as land, roads, buildings, water and sewer infrastructure, parks and machinery and equipment. Capital assets provide services to the citizens and consequently do not represent spendable resources. Collier County’s investment in capital assets, net of any related debt owed and depreciation, amounted to over $3.0Bn as of September 30, 2023. This investment in capital assets amounts to just over $7,500 per current permanent resident.

Total debt outstanding as of September 30, 2023, was $713.7M. This amount includes bonded debt, notes, loans, leases, and subscription-based information technology arrangements. On a per permanent resident basis this amounts to approximately $1,800. This amount decreased by $43.9M as scheduled debt service payments made exceeded new borrowings during fiscal year 2023.

Another important metric for local governments is unreserved, or unassigned, General Fund balance. These unassigned funds are available to the government for discretionary or emergency expenditure. Such funds are extremely important to a coastal Florida County like Collier, with a history of being impacted by tropical storms and hurricanes. The General Fund is the County’s principal operating fund and the recipient of a significant percentage of the County’s total annual revenues. Pursuant to generally accepted accounting principles the General Fund is used to account for all financial resources not required to be accounted for in another fund.

When external parties, like rating agencies, assess the financial condition of the County they generally consider the relative size of the General Fund’s unassigned fund balance. The larger the amount of unassigned fund balance the more resilient the governmental entity is to environmental or economic shocks. A healthy unassigned fund balance can directly impact the bond ratings of the County, with higher credit ratings resulting in lower interest costs when the entity must borrow to fund capital improvements. As of September 30, 2023, Collier County had $129.0M in unassigned fund balance in its General Fund.

For further information please visit our website at collierclerk.com for the complete FY2023 Annual Comprehensive Annual Financial Report or our recently published FY2023 Popular Annual Financial Report (PAFR). The PAFR offers is more condensed version of the Annual Comprehensive Annual Report, designed to be more readable.