In November of 2018 the citizens of Collier County, by the margin of 51% to 49%, approved a referendum allowing for the collection of a 1% Infrastructure Surtax. The surtax differs from the State sales tax in that the surtax applies only to the first $5,000 of the purchase price of an item of taxable personal property. The surtax is divided amongst Collier County and its three municipalities by the Florida Department of Revenue using the same formula used to distribute the half-cent sales tax. The distribution percentage is recalculated each year to reflect changes in population. Currently, Collier County’s share of the Infrastructure Surtax is 91.2% with the remaining 8.8% shared among the City of Naples, Marco Island, and Everglades City.

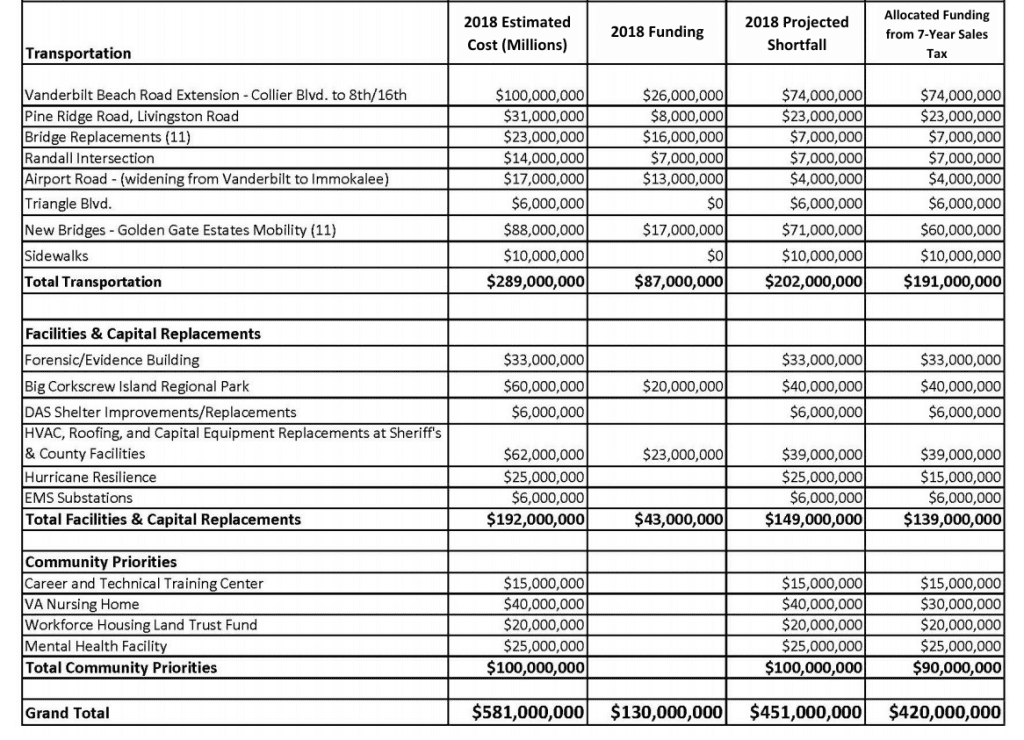

The tax was to be used for certain capital improvements within the County, including the extension of Vanderbilt Beach Road, Big Corkscrew Regional Park and certain community initiatives including a Veteran’s Nursing Home, a Mental Health Facility, workforce housing and a career and technical training center.

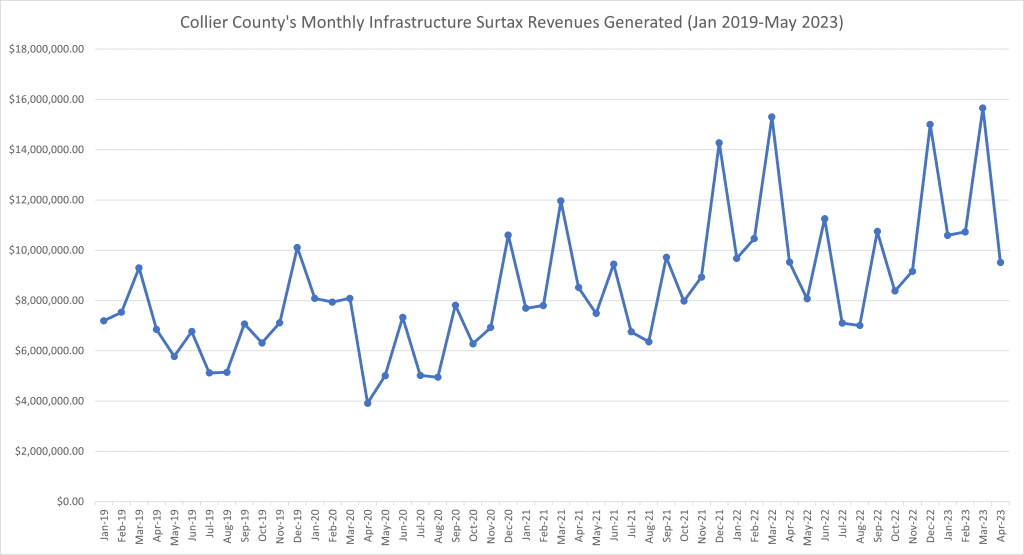

Collections began January 1, 2019, and were to continue for seven (7) years, or until the tax generated $490 Million dollars countywide (Collier County and its three municipalities). If the tax generated $490M prior to the expiration of the seven (7) year period, the tax would sunset, or cease to be levied, on December 31 of that same calendar year.

For collections through May 2023, the tax has generated over $490M, so the tax will sunset on December 31, 2023. In the interim, there will be seven (7) more months of sales tax collected, which will generate a surplus over the target amount of $490M. Some taxpayers may be wondering how we met this threshold two years earlier than anticipated. There are several factors that have contributed to the accelerated collection pace including a flood of new residents during and after COVID, unprecedented inflation impacting key industries in our market, and overall economic growth.

To date, $157.3M of the Infrastructure Surtax has been expended. Of this amount, $38.6M has been spent on Big Corkscrew Island Regional Park, $33.6M has been spent on the Vanderbilt Beach Road extension, $30.0M was placed in escrow with the State of Florida for a Veteran’s Nursing Home and $24.3M funded bridges and related structures.

The Infrastructure Surtax was intended to fund budget shortfalls on specific infrastructure projects. The question that will now have to be answered is how, and to what the surplus funding will be allocated. Certainly, one option that the Collier County Board of County Commissioners might consider is dividing the surplus funding ratably to cover project overruns because of increasing labor and material costs on the approved project list. For example, one of the largest projects to be funded through the Infrastructure Surtax was the Vanderbilt Beach Extension. The tax was originally budgeted to fund $74M of the $100M project, but the total construction cost alone has increased to over $150M. Many factors will have to be considered here, including the availability of other sources of revenue to cover the shortfalls.

The next likely step is for the Collier County Board of County Commissioners to create an Executive Summary to formalize the end of surtax collections as of December 31, 2023.