Have you been considering making energy-efficient upgrades to your home in 2024? You may be hearing information about the Collier County Property Assessed Clean Energy (PACE) program that has you questioning if it’s a good fit for you. The Clerk wants to help homeowners make informed decisions when investing in their property and making home improvements. That’s why the Clerk’s Office of Inspector General (OIG) has been conducting periodic reviews of the Collier County PACE programs since their inception in 2017.

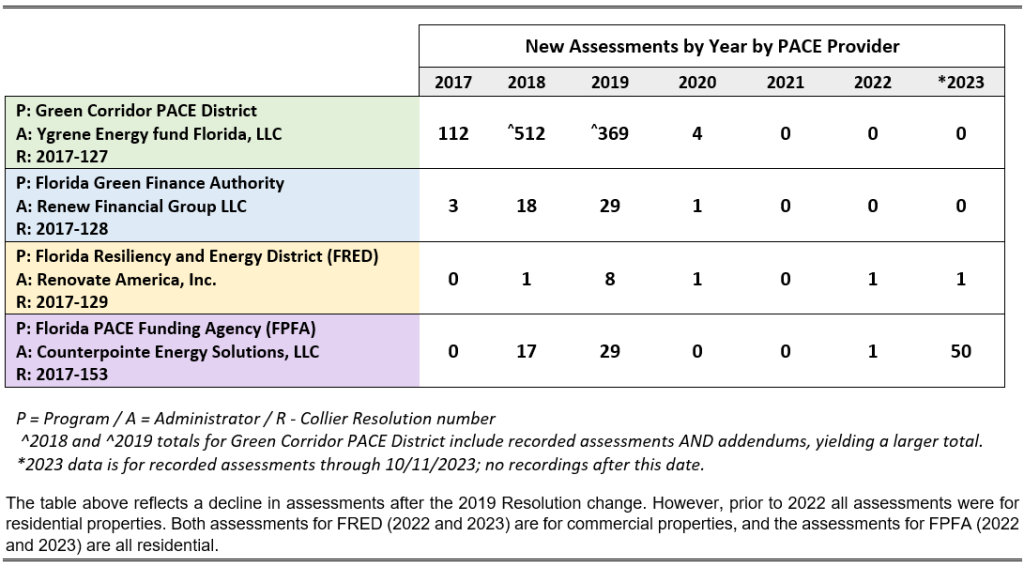

The Collier County Board of Commissioners (BCC) entered its first interlocal PACE agreements in 2017. It resulted in four different programs: 1) Green Corridor PACE District, 2) Florida Green Finance Authority, 3) Florida Resiliency and Energy District (FRED), and 4) Florida PACE Funding Agency (FPFA). The original agreements allowed for residential and commercial properties to participate in the programs. The history of Collier activity in these four programs is as follows:

In 2019, the OIG investigated complaints about the PACE programs not being in statutory compliance and targeting seniors and homeowners who spoke English as a second language. The results of the OIG’s review of the first year of the PACE program in Collier County are outlined in the 2020.03 Inspector General Insights report. The OIG’s 2022.15 report includes findings of irregularities with some of the PACE contractor documentation filed with the Clerk’s office. The OIG referred one such case to the State Attorney’s Office, which resulted in an arrest for a Scheme to Defraud, a first-degree felony.

The BCC entered into its second interlocal agreement with the FPFA in 2019, which resulted in Collier County Resolution 2019-123. The resolution limited the FPFA to only enter contracts with Collier County commercial property owners, making residential properties ineligible.

The FPFA provides upfront funding options for clean-energy home improvements. That program is intended to use property liens to allow taxpayers to repay the loans (at a variety of interest rates) through property tax assessments for up to 30 years. PACE liens take priority over any other liens placed on the property, including mortgages.

Last year, the OIG reviewed recorded liens and determined the Florida Pace Funding Agency (FPFA) was filing liens in violation of their local agreement. The FPFA had filed 50 new “residential” liens with the Clerk’s Recording Department. The residential contracts were a violation of the interlocal agreement and the Collier County Resolution. The recorded liens indicated homeowners had made home improvements such as impact windows and doors (48% of liens at an average term of 26 years), roofing services (22% of liens at an average term of 24 years), solar systems (18% of liens for 30 years), water treatment systems (10% for 15 years), and HVAC units (2% for 10 years). The loan contracts included interest rates ranging from .99% to 9.99%, with most of the loans being issued to residents of rural Golden Gate Estates area. As a result of these $1.94M of new residential liens, the Collier County Tax Collector requested that the BCC issue a Cease-and-Desist letter to stop the FPFA from entering any additional contracts. After the BCC letter, the Clerk’s Recording Department has not received requests to record new liens.

The OIG later discovered that at least 30 other Florida counties were refusing to record liens for FPFA, and many have filed related lawsuits. At the September 12, 2023 Board of County Commissioners meeting, Rob Stoneburner, Collier County’s Tax Collector, stated that he will not collect tax assessments on new residential contracts that violate the Collier County interlocal agreement. In a recent Tampa Bay Times article, Collier County Tax Collector Stoneburner advocated for more clarity on interlocal agreements to ensure consumer protections.

Throughout the new year, the Clerk’s Office of Inspector General will continue to monitor PACE lien recordings, and judicial proceedings to keep homeowners informed. We encourage Collier County citizens to subscribe to the Clerk’s newsletter for updates on important homeowner issues, and to use the Clerk’s website for our many public services.