As of February 29, 2024, Collier County had $636,554,000 in outstanding debt. This includes money borrowed for general governmental projects, such as roads, bridges, buildings, and sports stadiums as well as Water and Sewer District plants and infrastructure. Using the current population estimate of 399,480 for Collier County, Florida, that is $1,593 per permanent resident. For perspective, Sarasota County, Florida had a per capita debt of $1,600 as of September 30, 2023, and Manatee County was at $1,615 per citizen as of the same date.

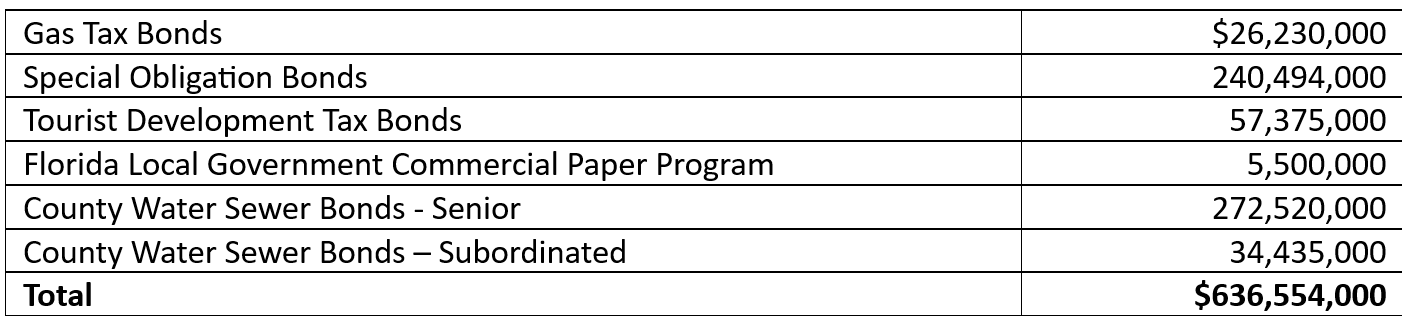

As of February 29, 2024, Collier County had the following outstanding debt:

Generally, governments borrow money for the acquisition and construction of infrastructure projects that will benefit current and future citizens. The concept is to amortize the cost of the asset across future periods so that the costs are shared by current and future residents. Borrowing for operating purposes is only recommended for short term needs in times of emergency. Collier has not used debt for operating costs.

Interest, one of the main considerations when borrowing, is the consequence of amortizing the cost of big-ticket capital purchases over time. The rate of interest paid per Collier issue varies, but Collier’s overall weighted cost of capital is a relatively low at 2.67%. The interest rate is determined by a number of variables, including strength of the underlying credit used for repayment, length of repayment term and the amount borrowed.

Governments enjoy the privilege of borrowing on a tax-exempt basis. This means the interest that the borrowing government pays to the bond holder is not subject to federal income tax and thus the bondholder is willing to accept a lower rate of interest up front. This gives governments a distinct advantage when borrowing and, as such, certain important rules have to be followed. Foremost among these are that the underlying acquisition or capital project must be for governmental purposes and, generally, the proceeds of the debt may not be invested to earn more interest than is paid out on the debt.

Collier’s current outstanding debt is a mix of bonds and loans used directly for capital asset acquisition and those used to refinance former debt to more favorable interest rates due to market changes. The Office of the Clerk and Comptroller, in cooperation with County staff, aggressively pursue refinancings that provide material savings.

This has become more challenging in recent years subsequent to the Tax Cuts and Jobs Act of 2017. This Act removed the ability to advance refund debt and thus narrowed the window within which tax-exempt debt can be refinanced with a subsequent tax-exempt issue.

In certain circumstances, Collier County may elect to borrow on a taxable basis. Reasons for this include allowing for the advance refunding option by using taxable bond proceeds for refinancing purposes and to allow for certain private involvement in projects.

Much of Collier’s current debt is directly held by financial institutions who were awarded the issuance based upon lowest interest cost. Other debt was issued by public offering and is owned largely by investment firms, pension funds and insurance companies. The public offerings carry annual reporting responsibilities that require that the Clerk and Comptroller’s Office upload Annual Comprehensive Financial Reports and various operating information to www.msrb.org.